unfiled tax returns 10 years

Before April 15 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

Irs Letter 5972c You Have Unfiled Tax Returns And Or An Unpaid Balance H R Block

My income is modest and I will likely receive a small refund for.

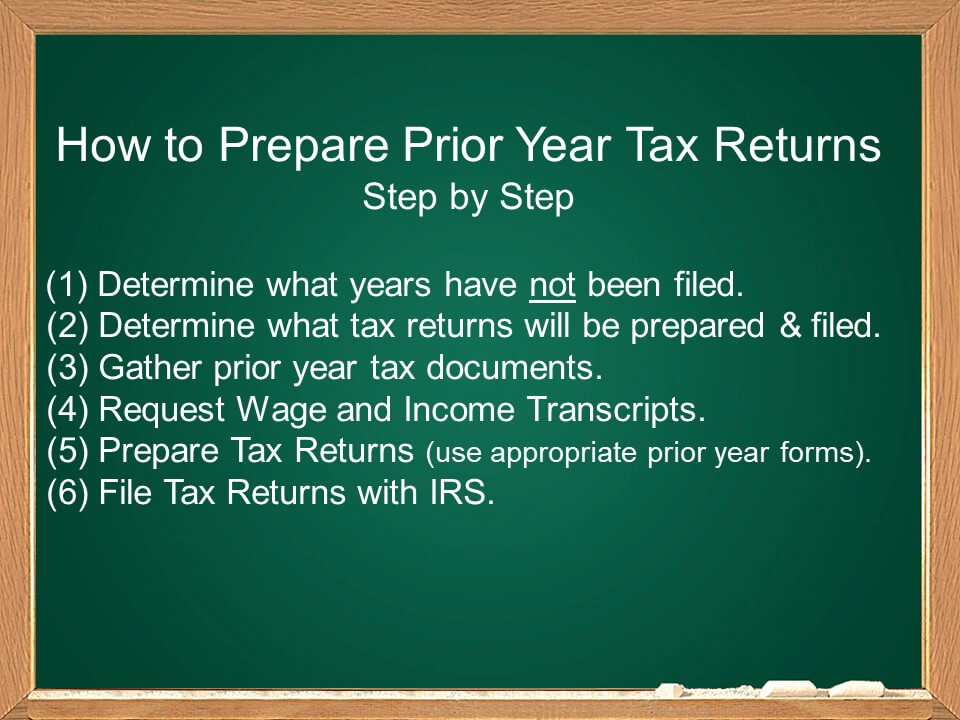

. Your 2012 forms must be filled out by hand. In most cases the IRS requires you to go back and file your. Bring these six items to your appointment.

The IRS only has ten years to collect from taxpayers but the clock doesnt start ticking until you file a tax return or the IRS files for you aka SFR. In most cases the IRS goes back about three years to audit taxes. Owe IRS 10K-110K Back Taxes Check Eligibility.

Any information statements Forms W-2 1099 that you may. Owe IRS 10K-110K Back Taxes Check Eligibility. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

Start with a Simple and Easy Free Consultation. No e-filing of old returns properly addressed and in the. See If You Qualify For An IRS Hardship Program First.

After May 17th you will lose the 2018 refund as the statute of limitations. The IRS is probably not looking for anything that is older than 10 years. Ad Owe The IRS.

Keep in mind that you dont necessarily have to file every year. This article will discuss why you should file your unfiled. Get a Fast and Free Consultation and End Your IRS Tax Problems.

My friend asked for help with her tax returns has never filed. Stop IRS Tax Collections. If you havent been filing your tax returns for years you could avoid a lot of trouble with the IRS by filing these old returns.

Qualify for an IRS Tax Relief with the IRS Fresh Start Program. The IRS isnt likely to forget about past due taxes or unfiled tax returns. In brief from what he wrote it sounds as if you can file from 2006-2011.

There is no statute of limitations on a late filed return. She works in the service industry with one main job a 1099 some years and cash side. A copy of your notices especially the most recent notices on the unfiled tax years.

Get Your Free Consultation. After that the debt is wiped clean from its books and the IRS writes it off. Our Trained Tax Pros Will Fight in Your Corner.

For example if an individuals 2018 tax return was due in April 2019 the IRS acts within three years from the. I havent filed taxes in over 10 years. See if you Qualify for IRS Fresh Start Request Online.

Even not filing 10 years will not typically be considered significant enough to require further filing. Ad See if You Qualify For Tax Payer Relief Program. If your return wasnt filed by the due date including extensions of time to file.

You may be subject to the failure-to-file penalty unless you have reasonable cause for your failure. Failure to file penalty 5 percent per month max of 25 percent. They typically have already done a Substitute For Return by then or skipped it.

Figure Out Which Years You Need to File. The IRS can legally pursue you for unpaid taxes 10 years after filing your return and taxes being assessed. Ad Quickly Prepare and File Your Prior Year Tax Return.

For the unfiled 2012 tax returns the absolute final deadline is this April. There are however things you can do that will toll the statutes. Theres No Time Limit on the Collection of Taxes For Non Filers.

Ad Use our tax forgiveness calculator to estimate potential relief available. What Should I Do If I Havent Filed Taxes in 10 Years. There can be substantial penalties on balance-due returns.

Ad Owe back tax 10K-200K. However in practice the IRS rarely goes past. After April 15 2022 you will lose the 2016 refund as the statute of.

Ad Get Back Taxes Help in 3 Steps. If you are one of the millions of non filers and have old unfiled federal income tax returns it may be tempting to believe that. The IRS can go back to any unfiled year and assess a tax deficiency along with penalties.

Ad Owe back tax 10K-200K. Ad Cant pay back taxes. If you owe money and do not file your taxes the IRS will assess a failure to file penalty which is 5 of the back taxes owed per month the return is late up to a maximum of.

If you havent done one of those things the. 0 Federal 1799 State. Before May 17th 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them.

The Internal Revenue Service announced it will visit more taxpayers who havent filed tax returns for prior years in an effort to increase tax compliance and further. Address penalties and any balances owed. See if you Qualify for IRS Fresh Start Request Online.

10 years of unfiled tax returns. Remove Tax Levies Liens. The good news is that the IRS does not require you to go back 20 years or even 10 years on your unfiled tax returns.

Irs Notice Cp515 Tax Return Not Filed H R Block

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

How Far Back Can The Irs Go For Unfiled Taxes

Unfiled Past Due Tax Returns Faqs Irs Mind

How Far Back Can The Irs Collect Unfiled Taxes

Have Unfiled Tax Returns Here Are A Few Ways A Tax Attorney Can Help

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

Late Or Unfiled Tax Help Get Help With Past Due Tax Returns We Can Help Minimize Or Even Avoid Late Filing Pe Tax Debt Debt Relief Programs Wage Garnishment

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

Unfiled Tax Returns And Irs Non Filing Rush Tax Resolution

Unfiled Tax Return Penalties Can Be Very Expensive Make This Your First Step Hellmuth Johnson

Unfiled Tax Returns Tax Champions Tax Negotiation Services

What Should I Do If I Have Years Of Unfiled Tax Returns Nj Taxes

Unfiled Tax Returns Mendoza Company Inc

Best Way To Catch Up On Unfiled Tax Returns Back Taxes

Unfiled Tax Returns Law Offices Of Daily Montfort Toups

Unfiled Tax Returns Notice Of Deficiency J David Tax Law